Zamtel has in partnership with Fintech PremierCredit launched the PremierInvest product on its mobile money menu. PremierInvest is a peer-to-peer lending product by PremierCredit and is a first mover in the Zambian market. The platform connects investors from around the world to borrowers in Zambia, and it is regulated under the Regulatory Sandbox of the Securities and Exchange Commission.

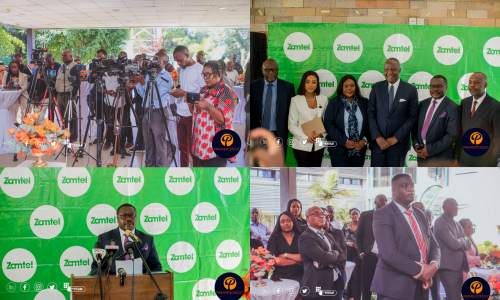

Zamtel mobile money has become the latest additional channel for customers to access the peer-to-peer lending platform. Subscribers on Zamtel’s mobile money will be able to access the investment product and earn 36% per annum in interest on their investments. Zamtel Acting Chief Executive Officer Joshua Malupenga said the company has partnered with PremierCredit to offer the investment platform that will allow subscribers to access the best and quickest online-based investment options. “This partnership will drive digital investment solutions in line with global trends and ensure that Zambia does not lag behind the digital financial development trends. This is in line with our strategic direction at Zamtel to grow local digital financial solutions to local digital financial challenges, that respond to the call in the 8th National Development Plan (8NDP) for universal access to finance,” he said.

The PremierInvest product is very inclusive as it allows people with non-internet-enabled devices to access the product offering through the Zamtel USSD channel.

Speaking during the launch, Chief Executive Officer of PremierCredit, Chilufya Mutale highlighted the importance of this initiative; “At the heart of our operations lies a dedication to financial inclusion. Our primary objective is to prioritize the needs of our customers by providing them with user-friendly inclusive products and services. In order to expand the availability of financial resources to those who lack access to traditional banking services and marginalized communities, we have augmented our investment product range within the Zamtel Mobile Money platform. This initiative aims to cater to a broad spectrum of individuals, including marketers, traders, and the general mass market.”

Minister of Science and Technology, Honorable Felix Mutati, who officiated the launch expressed his optimism in this strategic partnership and echoed the government’s efforts to drive Zambia toward financial inclusion. “Financial inclusion has been a top priority for our administration, and we firmly believe that no one should be left behind in our journey toward economic growth and development. We have been working tirelessly to create an enabling environment that promotes financial access and empowers individuals to take control of their financial well-being”, he said.

The PremierInvest product has been incorporated into Zamtel’s mobile money menu and is accessible to all subscribers, irrespective of their duration as a subscriber.

ABOUT ZAMTEL:

Zamtel is Zambia’s only total communication solutions provider. Zamtel is 100 percent owned by the Zambian Government through the Industrial Development Corporation (IDC). The company provides voice, data, fixed, internet, MPLS, and business continuity services to businesses and individual customers in Zambia.

ABOUT PREMIERCREDIT:

PremierCredit is an International financial technology company that operates as an online microlending and Investment platform in emerging markets in Sub-Saharan Africa. Our headquarters are in the business and cross-border investment hub for Africa, Mauritius. We are licensed and regulated by the Financial Services Commission (FSC), enabling us to provide inclusive financial services in the whole of Africa.

This is brilliant and it will help a lot of zambian people. Both the book smart and the street smart. Thank very much our government for such digital developmental efforts.